The Pyramid of Unsafe Acts: A Warning for America

For over two decades, I’ve hosted a “Boys’ Ski Weekend” around my February birthday. This annual bacchanalia has roamed from New England to Jackson Hole and, more recently, Park City, Utah. While the cast of characters has evolved, the itinerary—skiing, snowmobiling, great food, drinks, and plenty of laughs—hasn’t changed.

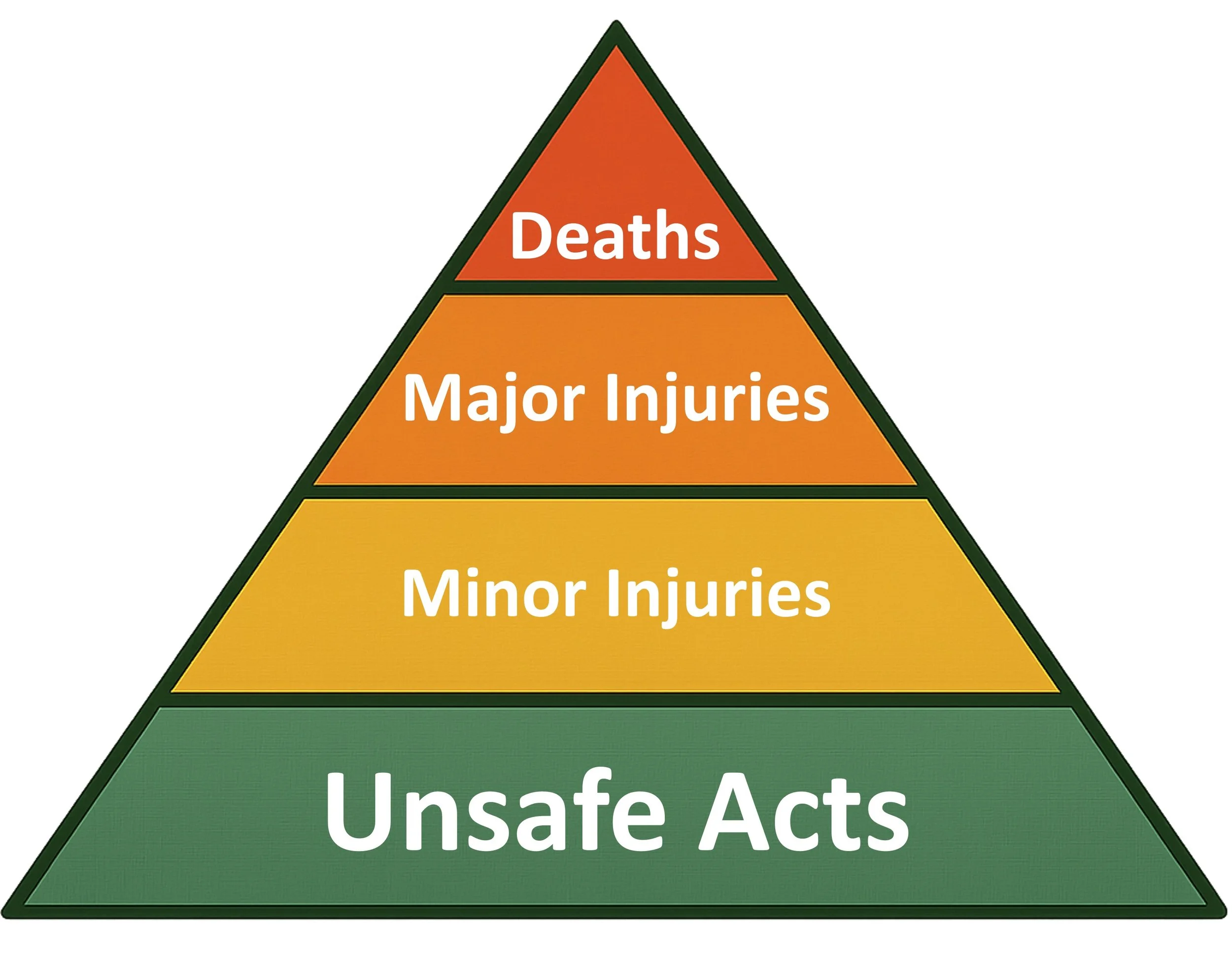

It was during one of those early New Hampshire trips that a buddy of mine introduced me to the “Pyramid of Unsafe Acts,” also known as Heinrich’s Triangle. Developed by Herbert William Heinrich in the 1930s, the model describes the statistical relationship between unsafe behaviors and their consequences: for every 3,000 unsafe acts, there are 300 minor injuries, 29 serious ones, and 1 fatality. Each level is an order of magnitude greater than the one above it.

Unsurprisingly, my engineer friend brought this up while we were engaged in some... let’s say... risky behavior. But the idea stuck with me. I’m drawn to concepts rooted in data—not opinion disguised as fact. And over the years, I’ve come to wonder: what would the Pyramid of Unsafe Acts look like when applied to society itself?

Unsafe Acts of a Nation

In a nation of 330+ million people, there are endless individual unsafe acts—reckless driving, drug abuse, overeating, criminal behavior. These often harm individuals and sometimes those around them. But what about the collective unsafe acts we commit as a society—acts that feel good in the short term but have long-term consequences?

Take voting, for instance. Our choices at the ballot box often reflect immediate desires without regard for whether it’s good for society as a whole. If we applied the Pyramid to government, what would be at its base? And what would be at its peak?

The Foundations of American Government

Let’s pause for a quick civics refresher—because too many Americans today are unaware of the fundamental principles that define our government. Our Declaration of Independence asserts that all people have natural rights—life, liberty, and the pursuit of happiness—and that legitimate government derives its power from the consent of the governed. More importantly, it states that whenever government becomes destructive of these ends, it is the right of the people to alter or abolish it. This is an important point many people miss, especially those who believe that Socialism-Marxism fits within the possible types of governments that can exist in our country.

Our Constitution was designed to keep the federal government limited and accountable. It established a three-tier system: local governments handle most issues, states cover what localities can’t, and the federal government is granted only 19 enumerated powers—things like taxation, common defense, currency, and regulating interstate commerce. Protecting civil liberties is the federal government’s most sacred job. This structure made the U.S. the greatest opportunity-creation machine in human history. We’ve had setbacks, yes, but we’ve also learned from them. Unfortunately, we’ve drifted from this foundation.

The New Pyramid of Unsafe Political Acts

At the top of the Societal Pyramid is the death of a nation: war, civil collapse, and mass suffering. At the bottom are acts that concentrate political and economic power. In the middle is Unsustainable Debt and Inflation and the Economic Collapse and Civil Unrest that are the consequences of that concentration of power. Contrary to popular belief, centralizing power—whether in corporations or government—is dangerous. Our country operates best as a distributed network, not a single point of failure mainframe. The history of technology bears this out, and I talk lots about this in my book, Locally Grown: The Art of Sustainable Government.

Now, some argue that we need concentrated political power to counterbalance corporate power. There’s some truth there. That’s why we have antitrust laws like the Sherman Act of 1890, which outlawed monopolies. But just like overusing antibiotics weakens the immune system, overusing centralized government weakens society’s resilience.

Follow the Money

There are plenty of good people in our country who disagree on the details of what constitutes the proper size and scope of federal government that protects individual freedom while balancing it with collective interests, that also lives within constitutional limits. For me, I think much of what the federal government spends money on is not strictly constitutional. There are those who think the federal government should be bigger and more powerful. They may pay lip service to believing there are constitutional limits on federal government when it supports their worldview, but scorn constitutional limits when their team is out of power. This isn’t sustainable thinking at is a root cause of political division. With all the disagreement and division in the country, there must be some way to objectively discern what unsafe political acts are.

Every government action involves money—who pays, who benefits, and how much is spent. If we’re spending $2 trillion more than we take in each year, we’re playing with fire. Currently, 75% of federal spending goes toward entitlement programs (Social Security, Medicare, Medicaid, welfare) and interest on the debt—exceeding even our national defense budget, which is a core constitutional duty. How long can the federal government continue to spend more than it takes in and add to an already unsustainable federal debt that represents 125% of our gross national product? Congress controls spending, but many in Congress are incentivized to spend recklessly to stay in power. Serious reform won’t happen until a crisis forces it and then there will be great public clamor to increase government spending because of the economic calamity caused by too much government spending.

Lessons from Abroad

From the Roman Empire to the Soviet Union, history is littered with the corpses of corrupt centralized government that spent and stole beyond its means. We are witnessing just such a slow-motion train wreck in Europe as we speak. Italy’s public debt is 135% of GDP. France: 113%. Spain and the U.K.: over 100%. Germany’s debt is above 60% and climbing. These countries, also NATO allies, are pledging to spend more on defense as Russia grows bolder. But their economies are brittle, their demographics skew old, and their political will is weak.

A case in point is the UK. Their current Prime Minister, Keir Starmer and his Labour party were elected in a landslide four months ago and their first attempt to reign in social spending was summarily rebuffed, as the Wall Street Journal reports:

“The crisis of the welfare state—fiscally unaffordable but politically unreformable—afflicts nearly every 21st-century Western democracy. And the revolt last week against British Prime Minister Keir Starmer’s modest disability reforms shows how deeply the entitlement state mentality is entrenched. At issue were so-called personal independence payments for those who struggle with tasks like bathing, preparing food or managing finances owing to physical or mental infirmities. Sounds compassionate, but more Brits than ever are claiming anxiety and depression to qualify. As many as a thousand people each day are signing up for an allowance that can exceed $250 a week.

Some 2.8 million jobless Brits are now classified as long-term ill, and the government says one in 10 working-age people now claim a sickness or disability benefit. Personal independence payment awards have more than doubled since the pandemic. British spending on working-age, health-related benefits has skyrocketed to £52 billion from £36 billion over the past five years, according to the London-based Institute for Fiscal Studies.

Mr. Starmer sought to tighten eligibility requirements, but his own party revolted. More than 120 Labour MPs threatened to kill the reform bill outright. The government responded with concessions that shielded existing claimants from the changes, knocking billions off the total savings.”

For socialist governments like most of the EU countries, their tax rates are very high and their economies weak in comparison to ours. There is a mountain of research showing that higher tax rates don’t produce higher government revenue but rather further drive away innovators and investors as government revenue shrinks.

Back at Home

The U.S. isn’t immune. The Democratic Party’s socialist nominee for New York mayor, Zohran Mamdani, has called for increasing the city’s minimum wage to $30. Andrew Cuomo, his supposedly more moderate competitor, wants a $20 minimum. These guys will never learn because they don’t want to see the world as it really is. This refusal to see how incentives shape behavior is an unsafe political act.

So, what does the American Pyramid of Unsafe Political Acts look like?

At the base: Expanding government power and spending beyond constitutional limits.

In the middle: Unsustainable debt and inflation, eroding our currency and standard of living.

Near the top: Economic collapse, civil unrest, weakened national defense.

At the top: National death—metaphorically or literally.

The signs are flashing red. Social Security will cut benefits by 23% by 2030 if nothing changes. Rising interest rates and debt servicing costs will strain government and private sectors alike. And as our economy falters, adversaries like China and Russia will see opportunity. History tells us war often follows economic collapse.

A Way Forward: Fiscal Reform

So, what can we do? I think America made an important choice last fall when it elected Donald Trump as President and returned control of Congress to the GOP. There is plenty I don’t like about Trump but at least his and the GOP rhetoric is for smaller government when compared to the Democrats who have become a hard left party. We just had 4 years to watch what their agenda is. Trump’s DOGE cuts and his “Big Beautiful Bill” are far from adequate, but it is at least a start in reigning in the waste, fraud and abuse within government. Don’t listen to the tired howling of those who think the world is coming to an end because we are introducing some work requirements for Medicaid recipients.

Shutting down our southern border and deporting illegal immigrants will also save hundreds of billions in benefits these illegal immigrants receive both directly and through use of our public schools. Sure, immigration continues to be an important part of our story, and we need folks to pick our crops, but it must be orderly, and rules based. As a sovereign nation, we get to choose who comes in based on our needs. We cannot have an invasion of aspiring workers while the government pays millions of citizens not to work. The Biden administration’s open border policy falls squarely into the category of an “unsafe political act.”

Then there is climate change and its horrible misallocation of resources to green energy solutions which is outrageously expensive and has destabilized our power grid when compared to a balanced mix of fossil fuels and nuclear energy. Not to mention that all the green economy hogwash will never reduce atmospheric carbon when China, India and the third world continue to burn fossil fuels. Spending more than $1 trillion on this was surely an “unsafe political act.”

Don’t mistake my disdain for the policies of Democrats as a resounding endorsement of all the policies of the current GOP administration. Anything more than true reciprocal tariffs is a bad idea. It is just a tax that will add to inflation and is certainly an unsafe political act. So is eliminating taxes on Social Security and tips and raising the federal deductions for state and local taxes (SALT). We need tax revenue along with spending cuts.

Six years ago, in my book, I outlined a plan that includes a combination of meaningful spending cuts and new taxes that can get our country on a sustainable fiscal footing. Here’s a bullet list of the plan, updated with current numbers:

1. Current State: As of 2024, the US federal government collected $4.9 trillion, or 17.1% of GDP, about the average since 1960. On the other hand, the federal deficit was 6.4% of GDP in 2024, significantly higher than the 3.5% average since 1963. In 2024, the deficit was $1.8 trillion.

2. Waste Reduction: The Congressional Budget Office believes that waste, fraud and abuse (WFA) represents up to 10% of federal spending. This is a potential $680b savings, reducing the deficit to $1.12 trillion.

3. Medicaid Reform: Block grant Medicaid to states. No more dollar-for-dollar reimbursements to states. States will learn from each other how to efficiently deliver services to the most deserving people. The Heritage Foundation estimates this approach would save about $100 billion annually. This reduces the deficit to about $1 trillion.

4. Social Security Reform: Eliminating the Social Security payroll tax cap — currently $168,600 in 2024 — would raise substantial revenue and significantly improve the program's solvency. In conjunction with raising the minimum retirement age from 62 to 64 and the full retirement age from 67 to 69, the estimated new annual revenue would be $200–$230 billion. These reforms could fully eliminate the program’s long-term funding shortfall, according to the Social Security Administration. Our annual deficit is now $770 billion.

5. Defense Reform: After an initial WFA cuts, fund defense at least to 4.5% of GDP. Institute a modern GI Bill—three years of military service earns discounted tuition, creating patriotic, productive citizens.

6. Wealth Tax: Increase taxes for the top 0.1% of earners with a 1% surtax on liquid assets. This would be treated like a withholding tax that is deducted on a quarterly basis just like portfolio management fees. It would raise about $78b in gross revenue. Accounting for compliance and avoidance, economists often reduce the effective yield by 20–40%. So, the realistic range is: $45 to $70 billion in additional revenue per year. This makes our annual deficit $700 billion.

7. Import Tariffs: Import Tariffs of 10% on the $3.65 trillion of annual goods and services imports raises a gross amount of $365 billion per year. This 10% number is roughly equivalent to the average reciprocal tariffs other countries charge us. Most economists estimate a 5–15% reduction in import volume if such a tariff were imposed. Realistic revenue range: $300–340 billion/year. Now our annual deficit would be about $360 billion.

8. Interest Expense Reduction: The Federal Reserve can lead the charge in reducing the average interest rate on the U.S. federal debt by 1 percentage point which would lead to substantial annual savings. Total U.S. federal debt: ~$37 trillion. Average interest rate: ~3.2%. Current annual net interest payments: ~$1.2 trillion. Only new or maturing debt gets re-priced at the new lower rate. Full effect of the rate drop might take 5–10 years to fully ripple through. Maximum interest savings is about $300-$400 billion/year. Our deficit is now gone.

9. Balanced Budget Amendment: Lock it in legally, with exceptions only for war or emergencies.

Together, these changes would eliminate the deficit and return the government to a fiscally sustainable path. A stronger dollar, lower interest rates, and higher growth would follow. And yes, we’ve done it before—under President Clinton in the late 1990s.

Unsafe Acts Beyond Money

Not all unsafe political acts are financial. January 6 was a shameful, illegal event, and President Trump deserves blame. His divisive rhetoric and loyalty-first personnel choices are troubling. But, the relentless attacks on him—some based on manufactured narratives by government agencies—have eroded public trust in our institutions. The two assassination attempts during the 2024 campaign show just how toxic our politics have become. Regardless of your views on Trump, weaponizing government against political opponents is an unsafe act of the highest order.

The Stakes

We can fix this—but we need leaders with political courage and voters who demand accountability. The fiscal path I’ve laid out isn’t utopian. It’s practical, balanced, and fair. It asks more from the wealthy but demands better performance from government. It strengthens our military and restores our economy. It replaces the Pyramid of Unsafe Political Acts with responsible governance. The alternative? Continued decline, deeper division, and a future we won’t recognize. A future we would not want for our kids and grandkids. Let’s choose wisely.